More Transactions Occurring in Teton County Real Estate Market

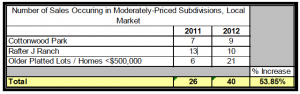

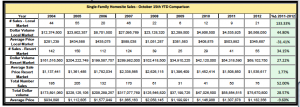

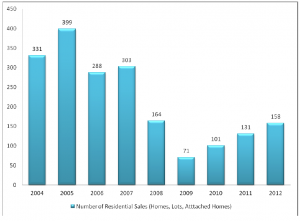

Observing data through mid October (10/15/12), an increase in the number of transactions of over 27% was noted in comparison to 2011 data from this time period. This gain came in combination with an average price measure that remained essentially level. The result of these indications was an increase in dollar volume of sales of over 20%. Closer observation of the data provides that this generalization is reasonably accurate, but worth clarification when viewing the market when segmented into its component parts of the more expensive resort market versus the less expensive local market. When viewing the market in this manner, it is noted that the average price of transactions in the local market decreased by 14.35%, while resort segment of the market showed an increase of 2.52% for its average price. The trend of level-to-increasing average price trends in the resort market with decreasing trends for the local market existed in both the single-family home and vacant homesite markets. Attached homes showed a decreasing average value trend for both local and resort segments of the market. That said, it is important to note that the decreasing average price measures for the local market are not indicative of a devaluation trend. Rather examination of the dataset shows that, in the local market, simply more sales occurred in areas typified by lower-priced real estate in 2012 through October 15th, than the same period in the preceding year. This statement is supported by the a sampling of single-family home sales in the neighborhood of Cottonwood Subdivision, Rafter J Ranch Subdivision and homes less than $500,000 in the older platted areas of Jackson (filings such as the Karns Addition, Redmond Addition and Nelson Addition – as examples). This sampling indicated that the number of homes from the more moderately-price areas of the local market increased by over 50% in 2012 year to date, as compared to the same period of time the previous year.

(click on tables/charts to see enlarged view)

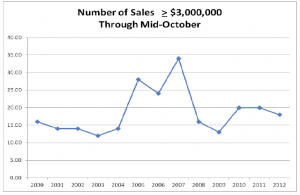

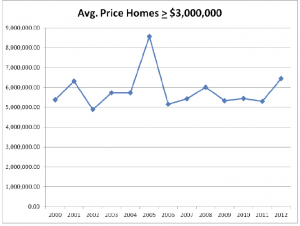

The preceding table provides support for the statement that the decrease in average price per transaction is due to the changing composition of the sales inventory rather than a decreasing value trend. Likewise, it is likely that the increase in the average price of the resort segment is due to the continued prevalence of very high-end transactions pulling the average indication higher, and not an appreciation trend as of yet. This statement is supported through the observation of the number of sales of single-family residences occurring with sales prices equal to or greater than $3,000,000 in the time period through October 15th. When viewing this data, it should also be noted that the average value of the price cohort of “> $3,000,000” increase significantly for the year-to-date data for 2012 (as compared to the previous year), which is indicative of several higher-end sales being contributory to pulling up the average pricing measure for the luxury market (as opposed to assuming a price growth trend in ongoing).

Summary of Market Statistics

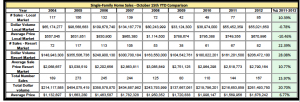

Vacant Homesite Market Segment

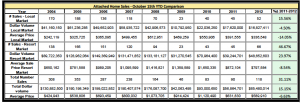

Attached Home (Condominium / Townhouse) Market Segment

Single‐Family Residence Market Segment

Combined Sales Data – All Property Types